Tailored and flexible healthcare

Providing health insurance for your employees helps shape a positive company culture by sending out a clear message that you value their health and wellbeing. Your employees are important to your business, and offering health cover is an effective way to help look after them.

Our small business health insurance provides access to prompt private hospital and specialist treatment, thereby improving employee productivity and reducing staff absenteeism due to ill-health.

Building your small business health insurance scheme

Choose from a comprehensive range of modular options, where each employee can have different benefits tailored just to them.

This allows you to create a tiered

healthcare structure that reflects your unique company requirements.

Essential Cover

Core benefits included in every Scheme

A comprehensive package of core benefits and forms the basis upon which to build your Scheme.

Hospital Treatment

In-patient and day-patient treatment

Out-patient Treatment

A range of out-patient treatment

Cancer Care

In-patient and day-patient treatment

NHS Hospital Cash Benefit

Cash benefit for NHS day-patient, in-patient and out-patient treatment

Health and Wellbeing Benefits

A range of health and wellbeing benefits

Optional Extras

Choose to enhance your cover

Optional Extras provide even more flexibility to tailor your benefits to suit your company's needs and budget.

Therapy (including psychotherapy/ psychology)

Overseas Emergency Treatment

Extended Therapy (Structured Counselling)

Cash Extras

GP Services

Dental Care

What's not covered

As with all health insurance Schemes, there are certain things that are not covered. For a full list of what isn't covered, please refer to the 'A Guide to Your Scheme', available as part of our quote process. Key exclusions include:

Pre-existing conditions

Dental problems (except limited cash benefits)

Long-term conditions (chronic conditions)

Fertility, pregnancy and childbirth

Cosmetic/aesthetic treatment

Allergic conditions

Looking for business health insurance for more than 14 employees?

Precision Corporate Healthcare combines private medical insurance, cash and dental plans together into a flexible scheme for 10 or more employees.

Precision Corporate HealthcareWe offer support in a variety of ways

There are times when we could all benefit from some extra help or advice, and the convenience of having access to support from the comfort of our own home is

invaluable.

That's why Enterprise Flexible Benefits includes a range of health and wellbeing benefits - available at a time and a place

convenient for your employee

Remote GP Services

Access to a GP either by phone or by video. Simply book online at My WPA or via our WPA Health app 24/7 to set up a GP consultation.

Structured Counselling

Provides short-term, solution-focused structured counselling. The EAP helpline will assess the most appropriate clinical pathway and agree the aim.

Employee Assistance Programme (EAP)

This 24/7 telephone support can help to keep your employees engaged, productive and help them overcome any issues that may be limiting their ability to perform.

Health & Wellbeing Hub

Our Health & Wellbeing hub provides access to a wide range of useful and valuable information. It's accessible via our WPA Health app or website.

Tailor your company's premium

Shared Responsibility is a co-payment feature that allows you to take greater control of your company's premium, whilst ensuring that your employees aren't compromised on benefits.

Unlike a traditional excess, 75% of treatment costs are paid, no matter how small. Employees share the cost of their treatment by contributing 25%. Their contribution is also capped at the chosen level for the Scheme year. Family member(s) may have a different level of Shared Responsibility to the employee.

WPA will pay 75% directly to the treatment provider. We will then inform the employee of their share which they will need to pay themself.

Their contribution is then taken from their level of Shared Responsibility.

Once they reach their level of Shared Responsibility, WPA will pay 100% of any eligible claims subject to their benefit limits.

When their Scheme membership is renewed, their level of Shared Responsibility starts again with the new Scheme year, even if the course of treatment started beforehand.

Shared Responsibility is applied per person, per Scheme year and not per claim.

Structured Counselling, NHS Hospital Cash Benefit, Therapy Optional Extra - Physio Pathway, Cash Extras Optional Extra, Out of Pocket Expenses, Hospice Donation, Wigs (Cancer Care benefit), GP Services Optional Extra, Dental Care Optional Extra - General Dental Treatment and Dental Emergencies.

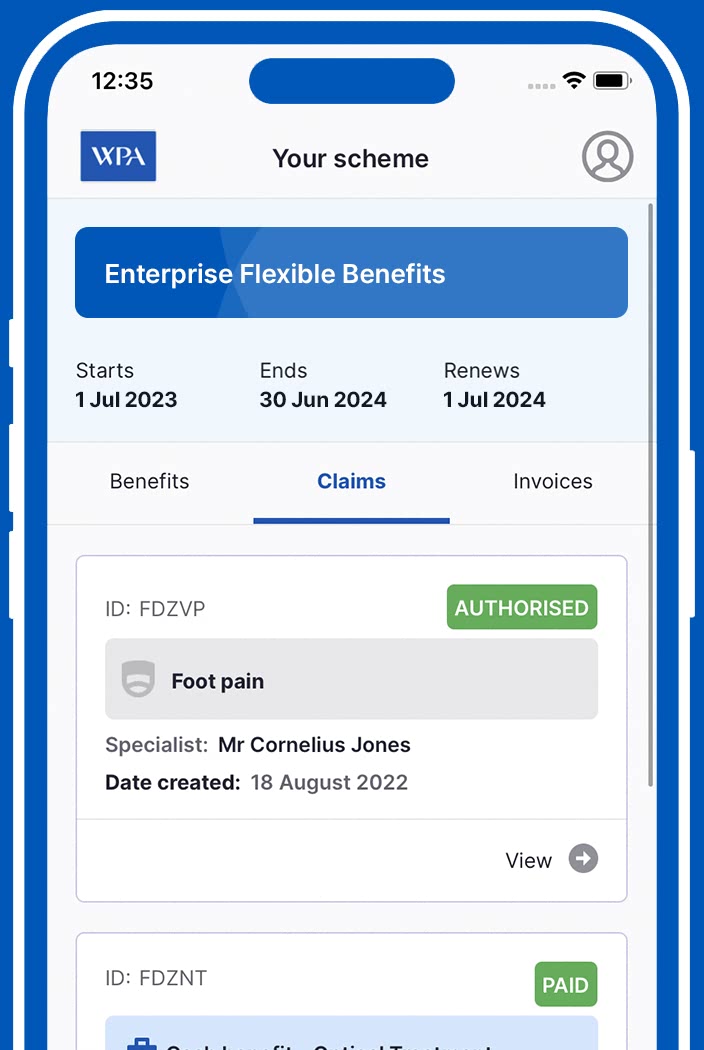

WPA Health app

Smart administration and claiming in the palm of your hand

When you're ill, getting an initial consultation with a medical professional is an important first step. Within a few minutes, you can receive pre-authorisation to visit a specialist - starting your treatment journey as quickly as possible.

Make a claim 24/7

Access Remote GP Services

View membership literature

Track claims & benefit limits

Send & receive secure messages

Health & Wellbeing hub

We believe that our policies should be easy to understand and easy to use wherever you are, which is why WPA Health is designed with customers in mind.

Frequently asked questions

Here's a selection of questions and answers that we've already helped our customers with.

Employer FAQs

How much on-going administration is there once the company scheme is set up?

What happens if one of our company scheme members wants to make a claim?

Can we mix and match cover between company scheme members?

Employee FAQs

How do I make a claim?

Will my employer be told when I make a claim?

What hospitals can I use?

What next?

Contact us

If you'd rather talk to someone about our Company Schemes, please give our UK team a call on 01823 625247.